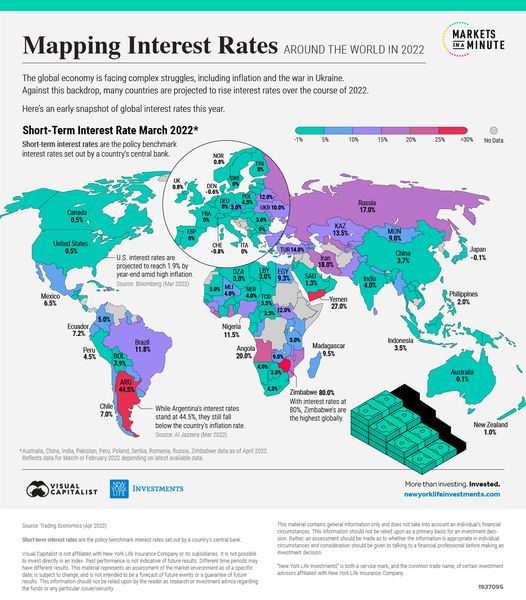

This interesting visual is courtesy of Visual Capitalist. We are still at an all time low in North America for interest rates but take a look at the rest of the world.

Our inflation rate is 6.7%. Household debt is at an all time high. There was $1.86 in credit market debt for every dollar of household disposable income.

What does this mean for someone in Supply Chain? Carrying costs are going to increase a lot so take a look at your inventory levels and see if you can reduce stock on hand. Are even better work with your suppliers to only have stock you need.

Employees are at risk of loosing their homes because of higher mortgage rates. Which means pressure on wages.

I am not sure we will see interest rates over 10% but it is better to plan then to be sorry.

Comments are closed